Introduction

In the finance sector, trust is the base upon which businesses build lasting relationships with their clients. Given the complexity of financial products and the significant impact these products can have on individuals’ lives, ensuring that customers feel secure and confident in their financial decisions is essential. Financial institutions face the continuous challenge of not only managing money but also maintaining and increasing consumer trust, which has been notably shaken by past financial crises. In this context, animated content emerges as an important tool for bridging the communication gap between financial services and their clients, effectively demystifying complex information and making it accessible and engaging. Animated content, with its unique ability to simplify and visually represent complex concepts, can significantly enhance understanding and consumer retention. By employing engaging narratives and visual elements, animations can break down hard to understand financial processes into simpler, more comprehensible pieces, making them more approachable for the average consumer. This method of communication not only educates but also engages clients, fostering trust through transparency and clarity. This article aims to explore the strategic use of animated content in finance to build trust with clients. Through examining real-world applications, assessing the impact of these strategies on customer relationships, and providing actionable insights and best practices, this piece will illustrate how animation can transform the way financial institutions interact with their clients, ultimately contributing to greater trust and client satisfaction. We will delve into the psychological effects of visual learning, present statistics demonstrating the effectiveness of animated content, and discuss the ethical considerations and future trends shaping this approach.

Understanding trust in finance

In the financial sector, trust can be defined as the confident belief in an institution’s ability to act in the best interests of its clients, to perform competently, and to handle all transactions and interactions with the utmost integrity and reliability. This is crucial in finance, more so than in many other sectors, because clients are often required to make decisions based on the information and advice provided by financial institutions, which can have profound implications on their economic health and future well-being. A study from the Journal of Consumer Research articulates that trust in financial services is foundational for consumer engagement with financial products and willingness to follow financial advice. Building and maintaining trust in the financial sector is fraught with challenges. The inherent complexity of financial products is a significant barrier. For many consumers, the details of investment products, insurance policies, mortgages, and retirement plans can be confusing and overwhelming. This complexity can create a disconnect, making it difficult for clients to understand what they are buying into, which can lead to mistrust. Perceived lack of transparency is another critical challenge. Financial institutions have often been criticized for not being clear about fees, terms, and the risks associated with financial products. The vagueness surrounding certain decision-making processes and the criteria for financial assessments can also contribute to this perception. Additionally, the sector has been plagued by a series of high-profile financial scandals that have undermined public trust. Events such as the global financial crisis of 2008, which was precipitated by the collapse of major financial institutions due to irresponsible lending and risky financial products, have left a lasting impact on consumer trust. Research indicates that these scandals have led to increased skepticism and reduced consumer confidence in financial entities. Rebuilding trust in this context involves addressing these barriers head-on, simplifying financial products, enhancing transparency, and adhering to ethical practices – all of which are vital steps toward restoring faith in financial institutions.

The power of animation in communication

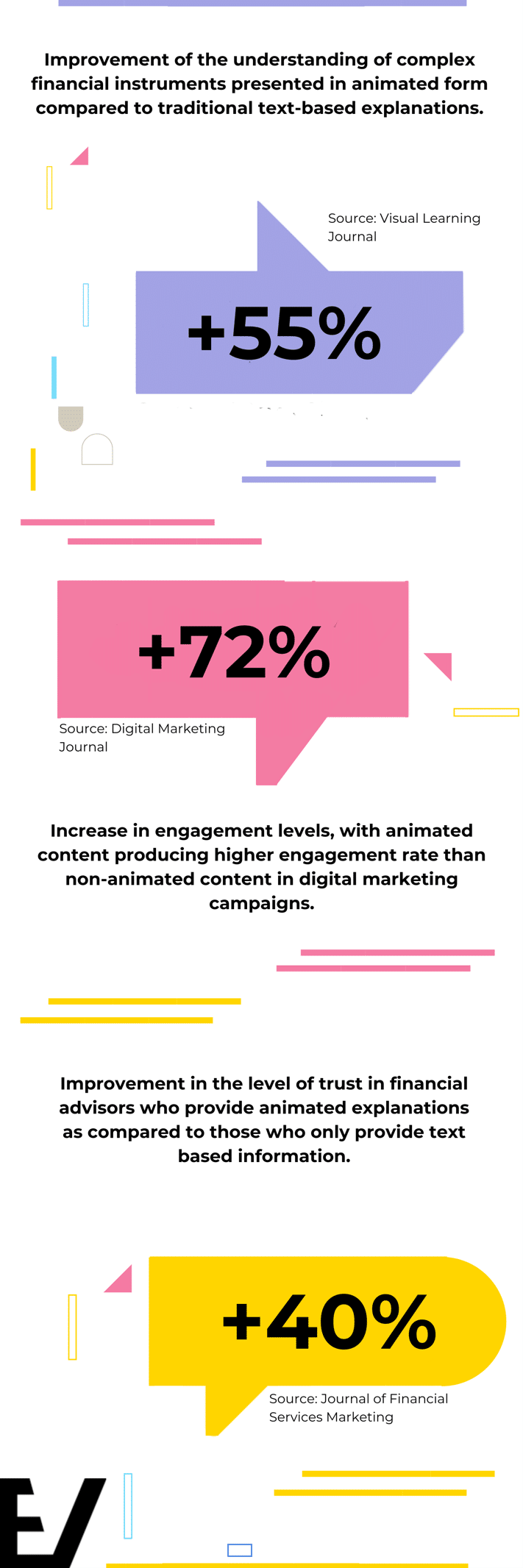

Animated content is particularly effective in the financial sector due to its ability to overcome linguistic and educational barriers, making it a versatile tool in global and diverse markets. Animation simplifies complex data and processes into understandable visuals, which can significantly enhance comprehension. For example, when complex financial products like mortgages or insurance policies are explained through animation, the information becomes more accessible. A study published in Visual Learning Journal notes that animation can improve the understanding of complex financial instruments by 55% compared to traditional text-based explanations. Furthermore, engagement levels see a notable increase, with animated content producing a 72% higher engagement rate than non-animated content in digital marketing campaigns, according to the Digital Marketing Journal. The psychological impact of animated content should not be underestimated. Visual storytelling through animation can significantly influence viewer emotions, which in turn affects how financial institutions are perceived by their clients. Animations are particularly effective at increasing perceived warmth and competence of financial providers. A key study from the Journal of Financial Services Marketing highlights that customers who viewed animated explanations rated their trust in financial advisors 40% higher than those who received the same information in text form. This is attributed to animations’ ability to humanize financial services, presenting information in a relatable and engaging manner that fosters a deeper emotional connection.

Case studies and examples

Bank of America’s “Better Money Habits”

Bank of America’s “Better Money Habits” initiative is a strategic partnership with Khan Academy aimed at providing free financial education to the public. This program utilizes animated videos as a key tool to enhance financial literacy among users of all backgrounds. Each video in the series is crafted to address common financial challenges and questions, ranging from how to build an emergency fund to understanding the nuances of credit scores. The animated format allows complex financial concepts to be presented in a visually appealing and straightforward manner, making it easier for viewers to grasp and retain the information. Animations are typically short, engaging, and feature relatable characters and scenarios, which help simplify financial decision-making. The series not only educates but also empowers viewers by providing practical, actionable advice. For example, one popular video explains the steps to setting up a budget, using animation to visually represent how budgeting can help manage expenses and save for future goals. Bank of America promotes these videos across various platforms, including social media and dedicated sections on their website, ensuring accessibility and encouraging users to take control of their financial health. This approach not only serves educational purposes but also strengthens customer relations by positioning the bank as a supportive and informative partner in financial management.

J.P. Morgan’s “Market Insights” Series

J.P. Morgan Asset Management’s “Market Insights” series represents a significant investment in using animated content to communicate complex market dynamics and investment strategies to a broad audience, including individual investors and financial advisors. Each piece in the series focuses on a specific market trend or investment topic, such as the impact of geopolitical events on global markets or the fundamentals of asset allocation. The animations are designed to simplify these concepts through clear, concise, and engaging visual storytelling. For instance, an animation might illustrate how different asset classes perform under various economic conditions, using visual metaphors and simplified diagrams to enhance understanding. This helps clients and advisors alike to make informed investment decisions based on J.P. Morgan’s analysis. Moreover, J.P. Morgan utilizes these animations in client meetings and online platforms, enhancing the interactive experience and making the learning process more engaging. The series also serves as a marketing tool, demonstrating J.P. Morgan’s thought leadership and deep knowledge. This fosters trust and confidence among clients, who view the firm not just as a financial service provider but as an essential resource for understanding and navigating the complexities of the financial world. The “Market Insights” animations are updated regularly to reflect the latest market conditions and economic forecasts, ensuring that the content remains relevant and valuable. J.P. Morgan also complements these animations with detailed reports and live webinars where analysts discuss the animated content and answer questions in real-time, creating a comprehensive educational experience. This blended approach of using both animated and interactive live content helps solidify the understanding of financial concepts, making it easier for clients to engage with and act on the information provided. By leveraging animation to clarify and visualize investment insights, J.P. Morgan not only enhances client engagement but also reinforces its reputation as a leader in financial education and advisory services. The success of the “Market Insights” series highlights the effectiveness of using animated content to bridge the gap between complex financial information and the everyday investor, ultimately contributing to a more informed and empowered client base.

Data and Statistics

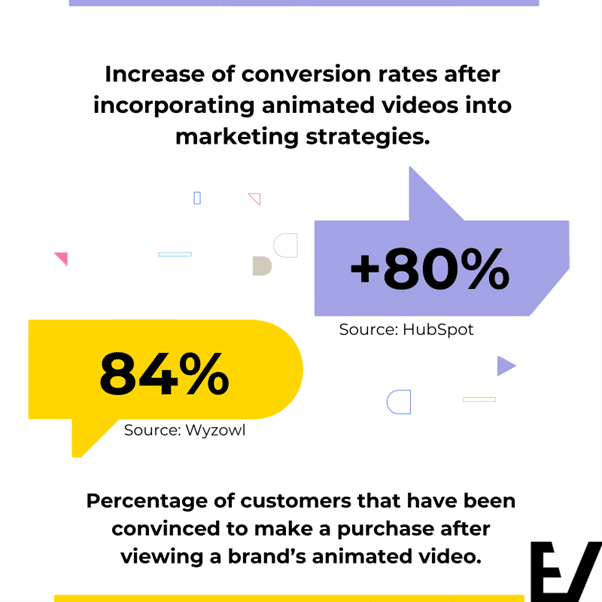

Recent statistics underscore the efficacy of animated content in marketing and customer engagement. For instance, according to a report by HubSpot, incorporating videos into marketing strategies can increase conversion rates by over 80%. Moreover, the use of animation specifically enhances this effect due to its ability to grab and retain viewer attention. A study conducted by Renderforest highlighted that businesses utilizing animated explainer videos saw an increase in sales by approximately 49%. The dynamic and visually engaging nature of animation aids in clearer communication of key benefits and functionalities of products or services, thereby boosting consumer understanding and engagement. When comparing animated content to traditional text-based or static image content, the advantages become even more apparent. A study by Video Brewery reveals that viewers retain 95% of a message when it is watched, whereas they retain only about 10% when read in text. Furthermore, research by Wyzowl indicates that 84% of consumers have been convinced to make a purchase after viewing a brand’s video, and the use of animation makes these videos particularly persuasive and memorable. In terms of trust-building, a survey by Animoto found that 58% of consumers consider companies that produce video content to be more trustworthy. This trust is further amplified with animated content, which tends to be perceived as more user-friendly and engaging.

Best Practices for Creating Trust-Building Animations

The first step in crafting effective trust-building animations is to thoroughly understand the audience. This means identifying not just demographic details like age and income, but also understanding their financial literacy, preferences, and challenges. This personalized approach ensures that the animation addresses the viewers’ specific needs and questions, thereby establishing a stronger connection and foundation for trust. Creating trust-building content involves several critical elements that must be clearly expressed in any animated video. Transparency and clarity are paramount, as they reassure viewers of the honesty and straightforwardness of the information presented. A study by Forbes highlights that content which directly addresses consumer concerns and queries with clear, concise information tends to build trust more effectively. Accuracy is equally crucial; as per a report by the Content Marketing Institute, factual errors are one of the fastest ways to undermine trust. Finally, relatability connects the content with the audience on a personal level, making complex financial concepts more accessible and understandable. On the technical front, producing high-quality animated content requires attention to detail in several key areas. The animation must be smooth and professionally rendered to convey seriousness and credibility. Tools like Adobe After Effects and Autodesk Maya are industry standards for creating polished, engaging animations. Furthermore, the audio quality, including voiceovers and background music, should be crisp and clear, as poor audio can detract from the credibility of the content. According to TechSmith, videos with high production quality are 30% more effective in retaining viewer attention than those with low quality, emphasizing the importance of technical excellence in building trust through animation.

Future Trends in Animated Content for Finance

The landscape of animated content in finance is ready for transformative changes, driven by rapid technological advancements and evolving consumer expectations. One of the most exciting trends is the integration of real-time data visualization into animated videos. This approach not only enhances the relevance and timeliness of the content but also boosts transparency, a crucial factor in trust-building. According to Gartner, by 2025, more than 50% of data stories will be automatically generated using augmented analytics techniques, including AI-driven data visualizations, enhancing the credibility and appeal of financial content. Another innovation is the use of 3D animation to create more engaging and realistic financial scenarios. This technique can help illustrate complex financial processes in a more intuitive and tangible manner, making them easier to understand for a non-expert audience. As per Animation Magazine, 3D animation is set to revolutionize educational content by providing a deeper, more interactive learning experience. The integration of animation with emerging technologies like artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) presents new opportunities for creating immersive and interactive financial content. AI can be used to personalize animated content in real-time, adapting to the viewer’s understanding and preferences. This personalization not only enhances the user experience but also strengthens trust, as users feel their unique needs are being recognized and addressed. Virtual reality and augmented reality take this a step further by placing the viewer inside the financial story. VR and AR can simulate financial environments or scenarios, such as the impact of investment decisions over time, in a fully immersive 3D space. According to a report by Deloitte, VR and AR in financial services are expected to increase customer engagement and satisfaction significantly by providing a more hands-on approach to learning about finance and making informed decisions. Together, these technologies are not just enhancing the way financial content is delivered; they are revolutionizing the interaction between financial institutions and their clients. By adopting these innovations, financial services can not only improve their educational content but also build stronger, more trusting relationships with their customers.

Conclusion

This article has demonstrated the critical role of trust in the finance sector and how animated content can effectively enhance this trust. Animation simplifies complex information, making financial services more transparent and accessible, thereby increasing customer satisfaction and engagement. We’ve highlighted case studies where financial institutions successfully used animation to improve communication, illustrating the significant benefits of this approach. Best practices and future trends were also discussed, emphasizing the importance of understanding the audience, maintaining accuracy, and exploring innovative technologies like AI and VR to enhance the interactivity of financial services. Creativity in finance, particularly through animation, breaks down traditional barriers, fostering a deeper connection and trust with clients. As financial institutions continue to innovate, the potential to transform financial communication and education becomes increasingly apparent, promising a more inclusive and transparent future for the industry. Ready to use animated content to enhance trust and engagement in your finance-related projects? Whether you’re a financial institution aiming to simplify complex concepts or a consultancy seeking to educate and empower clients, our team specializes in crafting compelling and informative animations tailored to your needs. Explore our portfolio and discover how we can help you revolutionize financial communication and build stronger relationships with your audience.

Check out our projects for the finance sector!